Listen To Article

Listen To Article

Key highlights:

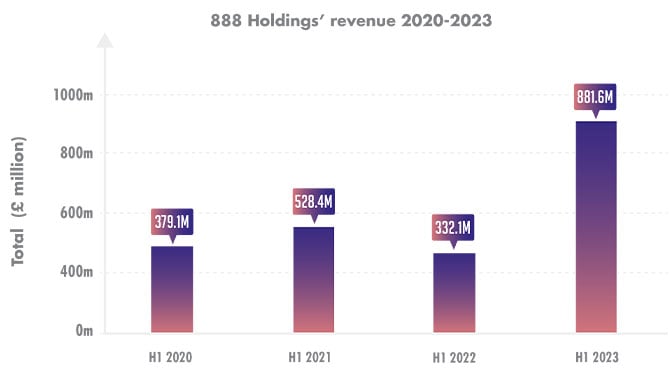

– H1 2023 revenue hits £881.6m (US$1.12bn), a 165% increase on H1 2022, beating its 2019 pre-Covid p of £811m

– Gross profit totals £590m – up from the £215.9m in H1 2022

– 888’s market cap (at the time of writing) hits £480.4m

888 Holdings has posted its H1 results for 2023, reporting revenue of £881.6m – a 165% increase on H1 2022.

The graph below shows the company’s revenue from 2020-2023, showing that H1 2023’s sum was significantly higher than the next largest sum of £528.4m reported in H1 2021.

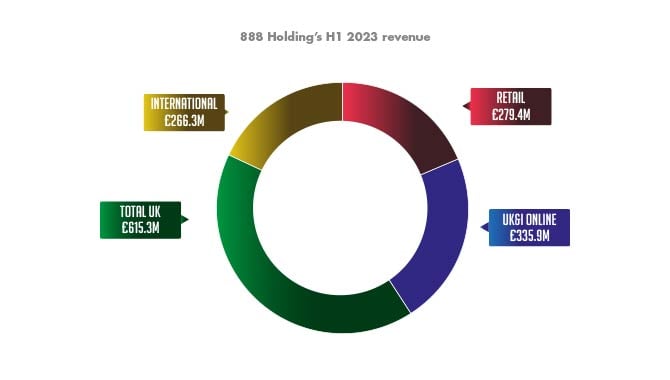

Breaking down its revenue, 888 made £335.9m from its UK & Ireland division, 208% above what it reported in H1 2022. Meanwhile, from its international arm, 888 posted £266.3m – representing a 31% increase on the same period last year.

Overall, its total UK revenue accounted for £615.3m of its total £881.6m sum, a sum detailed in the chart below showing 888’s revenue for H1 2023 and what it is comprised of.

Additionally, 888’s gross profit for H1 2023 stood at £590m, which is up on the £215.9m it posted for H1 2022 and the £352.4m from H1 2021.

Looking at 888’s H1 adjusted EBITDA for this year, which totalled £155.6m, this p represents a steady 9% rise on H1 2022’s £142.5m. In H1 2021, 888 reported an adjusted EBITDA of £97.4m and a £70.1m adjusted EBITDA p in H1 2020 – meaning that 888 has seen steady growth in the last four H1 reports.

However, when looking at 888’s full EBITDA, the picture that emerges is more dramatic. For H1 2023, it made £155.6m, but for H1 2022 it reported an EBITDA of £50m.

“I am very pleased with the progress we have made in the first half of the year as the Group delivered against the plans we committed to at our investor day last year, while also successfully navigating business, market and regulatory volatility” – Lord Mendelsohn, Executive Chair of 888

For H1 2023, 888 reported an adjusted profit before tax of £11.8m compared to the £31.9m in adjusted profit before tax it made in H1 last year – representing a sharp drop of 63%. However, neither of these compare well with the company’s H1 2021 adjusted profit before tax of £75.2m or the £50.4m it recorded in H1 2020.

Since the beginning of the year, 888 has seen its share price start well before suffering a drop, though it has recovered and is now recording slight growth on where it was on 3 January – when it saw its price start 2023 at £0.88.

Its high for the year came on June 16, when it hit £1.23 – and, at the time of writing, its price is recorded at £1.05.

Finally, 888’s H1 2023 net debt of £1.66bn fell against H1 2022, when it recorded a net debt of £1.73bn.